Notes?

I am starting to hate the notes used for the first round of a companies funding. The rules just continue to change.

I am starting to hate the notes used for the first round of a companies funding. The rules just continue to change.

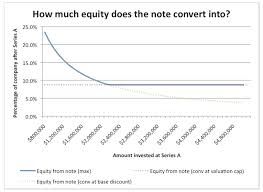

The notes start out with a cap but then it ends up that there are several caps on the same note. Transparency here would be nice. So the price you thought you were going to convert at is not the price. It is a blend of all the notes. Sucks for the investors.

Now I am seeing notes where when the VC comes in it isn’t about converting the original investors at the cap but the cap is now shifted to be a pre-money price point. Did I miss something?

I get the reason to do a note. It is quick, it is easy and it isn’t expensive to do. Also, you don’t need a lead on a note. When you have an equity round someone needs to set the price. The beauty of that is that once the investment is made then everyone knows exactly what they own. I do like fixed numbers.

There are even a few accelerators who now come in and want everyone to be re-priced so that the cap table looks different for them. Seriously?

I get the game. I understand why everyone plays it but I hate getting screwed. I want to know what I own when I wire. I don’t want to find out everything has shifted. That is why I get a side note. Of course lawyers hate the side note because they are under the belief that it will be hard for the entrepreneurs to get funded later on which is utter bullshit but whatever.

Just going off here. The first company that I was given an opportunity to invest in did a note. They had a real business with revenue. I told them I wouldn’t do a note and passed. They have gone on to be quite a large company. I don’t kick myself for that but it did make me think about getting over the note. So I did. Now I am really starting to rethink the note.

Comments (Archived):

I’m not sure I still quite understand why renegotiating current notes as part of the terms of a round is considered just one of the things that happens in investing. But, really, isn’t the impetus on the founders to speak up for those on their CAP table and those who hold notes, no matter how tenuous that conversation may be with a potential investor?

It is but its not easy When a great investor is sitting on the other side of the table with their sleeves rolled up and a big check it’s tough to not just follow suit

This is what I struggle with – are they really a great investor if this is an accepted practice for them? Doesn’t it mean they’ll have that same mindset in dealing with the founders at some later date when things hit a rough patch? Shouldn’t it be a red flag? (Sorry for all the questions, but very curious how other investors/founders see this.)

Sometimes the investors want to own a certain amount of the deal. It’s part of their thesis.Think of building a house. First you use an architect who is your heart and soul. Then you move to a contractor and they become your foundation

Good description. It helps a bit for me, although I don’t sign a contract with the architect to build it exactly as designed. I do sign a contract with investors who come in on a note. It’s a bitter pill to swallow to then be asked not to honor that to get a larger investment, but I do understand a bit better why it happens – and why it doesn’t seem appealing for investors like yourself – it isn’t as solid and can be a moving target for you even after your money is already spent.

Huge issue.As an investor I like priced rounds, as an entrepreneur i like notes.For no other reason that they are just simpler and honestly, legal fees around the priced round and usually changing the llc to a corp are just costly and a pain.

Manu at K9 wrote a good piece on why he dislikes noteshttp://www.k9ventures.com/b…To me series seed solves most of the problems notes were trying to invest in terms of complexity.

I hate notes. Economic incentives are misaligned. Have written about them here. http://pointsandfigures.com… As valuations creep higher, I am starting to ask for a 2X liquidation preference if they want a note with a high cap. Why should I assume all the risk?

This just happened to me; following this thread to see other readers’ replies. Hope to see more resources on notes from the perspective of an angel investor. Thanks!

What is a “side note”. Pretty aware of how notes in general work (I think) with caps, discounts, potentially liquidation prefences etc., but never heard the term “side note”, just curious if you could clarify what that means? I am guessing it means you just sign a note with a few special terms that you are comfortable with? Thanks in advance

Joanne – I feel your pain. I helped contribute to a good review of this – “Seven Surprises About Convertible Notes”, that may be useful to you and others: http://bit.ly/1ATjgn7

thanks Jeff. I love the title. Seven Surprises!

“the cap is now shifted to be a pre-money price point.” That sounds like an uncapped note. How can that shift if it was subscribed as a capped note? They would have to meddle with the by-laws.So is the side note as solid as the side letter for pro-rata rights?

i hope it is.

note = lack of conviction on part of entrepreneur and participating alike IMHO.

Thanks for the interesting post. Added to a collection of curated advice on this issue: myme.ms/1KkhlZOIf possible, it would be great to add a link to a generic sample side note, or any other docs people think are outstanding on this topic. Thanks again.

.Like a lot of things in business, it is the meeting of the minds and the challenge to make the documents reflect that state of mind that is driving things.There should never be a problem with enforcing the terms of a convertible note. The first thing, of course, is for everyone to understand the terms of a convertible note which, in my experience, is not a given.What I have done in the past and which has served me well is to use written examples of future “things” to document our understanding. “If this happens, then this happens.”I am very sympathetic to entrepreneurs who are faced with a substantial amount of funding in which the new investor says — “I hate your current cap table and structure. That’s got to change.”That is a real problem and I see it all the time.It is one of the risks and challenges of being an angel investor and using convertible notes.In the end, it has to be made to work and fairly. There are no easy solutions other than to remember that nobody gets what they deserve, they get what they negotiate.JLMwww.themusingsofthebigredca…

Do tell. Which accelerators are asking for re-pricing?

ah…not coming from me. but it is a big one.

As both an investor and an entrepreneur I dislike notes immensely for all the reasons you mentioned. The complexity, the fact that as an investor I want a cap but as an entrepreneur I want a floor which essentially means I’m pricing the round, just not very well.My last company raised 1.3MM in seed angel money in a priced round. It perhaps cost 5k in added attorney fees, but isn’t that just a drop in the bucket? These aren’t complex cap tables in the beginning, the shares are all equal, it’s just not a complicated agreement to do it as equity.Equity/Priced Rounds align the investors and entrepreneurs and eliminate most of the future crap you mention.As an entrepreneur, I like knowing that me and the group of angels who got in early are all on exactly the same footing if we are going to raise more capital.Convertible notes are essentially a big way of saying “I’m afraid to make a decision” which is the very thing you need most in an entrepreneur, decisiveness and leadership. As an investor, my thought is that if you can’t price your f***ing round, how can I trust you to make way harder decisions. Price it on the higher end if you can justify the valuation, price it on the lower end and (gasp) give away a sizable chunk of your company to people who are willing to take the big early financial risk on a totally unproven gamble.This is turning into a blog all it’s own… Great post.

could not agree more – “notes” today are litigation waiting to happen. and why even bother? all the original premises for convertible notes are no longer issues, or even true – a venture can do an equity fundraise as quickly, simply and inexpensively as a note.