Student Loans

Providing student loans to people who are looking to educate themselves makes total sense. Common sense would tell us that we should be giving out loans to people at very low rates so that in the future, they can be paid back without putting the loanee at risk. Unfortunately, that is not the case.

Providing student loans to people who are looking to educate themselves makes total sense. Common sense would tell us that we should be giving out loans to people at very low rates so that in the future, they can be paid back without putting the loanee at risk. Unfortunately, that is not the case.

When talking to most young adults applying for graduate schools, I hear that if they don’t get into the top school, they aren’t going because the cost is so high that without the top degree in hand, they are concerned that they won’t land the job afterward that will allow them to pay off their loans. This is mostly for lawyers and MBA students but how about artists, engineers, architects?

I was talking to someone who just got into graduate school. He got into all of the top schools in his field. His field is an important one and everyone who wants to better their education and brain should be able to do so at the right cost. Sure there are grants but none of them cover the entire cost. He got the biggest grants but still has to come out of pocket a significant amount of cash. I wondered if he should take out a loan instead of putting up the cash but he told me the student loans that he was looking had interest rates of 8%.

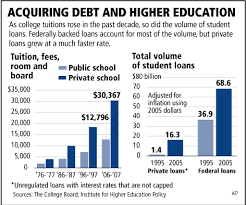

8%? The fact that lenders take advantage of people who are in need of a loan to get their education, undergrad, and graduate, is absolutely disgusting. As I have learned from my experience with FEMA, our Government is a business that tends to take advantage of its own. The Government should have a program that gives loans to students, is ridiculously low-interest rates, perhaps 90% under average. Data shows that an educated person has a better impact on the economy and quite frankly their life but when leaving school life for work life, nobody should be wrought in debt to make yourself an educated person.

8%! I just can’t get past it. This is a crisis in the waiting line. At one point, people will default on all of these loans and that isn’t good for anybody.

Comments (Archived):

The average medical student graduates with 200k in loans, however, since not all students take loans the average of those who take loans is even higher – that is a crushing burden and runs counter to our society’s needs. I completely agree that the government should be subsidizing these and 8% is crazy – with those numbers these students are typically paying double or more over the life of the loan.

It is just insane!

The average medical student graduates with 200k in loans, however, since not all students take loans the average of those who take loans is even higher – that is a crushing burden and runs counter to our society’s needs.My 2nd wife graduated medical school about 12 years ago with over $200k in loans. The interest rate was under 3% for most of the loans at that time. And payments could easily be deferred as well. Mix of government and private loans. She was living the poor life when she graduated and in her first job but mainly as a result of poor money management [1]. So with respect to medical school I don’t feel that a $200k loan balance at a reasonable interest rate is crushing at all. For one thing you can get in some cases (and with some of the debt) 30 years to pay it off. That is a long time. If you are in business and you buy a machine you don’t get 30 years to pay it off and you are not in any way almost guaranteed a secure stable income. I would add that with medical school in general you don’t even have to go to a top school. My wife is making a really good living (internal medicine not even a super highly paid specialty) and has no issue paying off any of the student loans that remain. And she went to a state school in NY. So I think the example of student loans is better to use with graduate school that leaves you with high loan payments and no stable secure job to pay off those loans. The issue is people going to school for advanced degrees (even what we used to call ‘professional students’) with no clear path to have any meaningful employment. $200k in loans to get a medical degree is a bargain honestly.[1] When we met I had to give her $2000 to pay expenses for the month when she burst into tears a few months after we met. However part of that was poor management. For example she was saving for retirement (she was in her 30’s) and keeping high credit card balances rather than paying off the credit cards and worrying about retirement a bit later. This made no sense to me so we discussed and she changed course upon my suggestion and reduced to a nominal level retirement savings and paid off the high credit cards and also reduced the student loan payments. Once she got into her second job and earned more she then increased the payments. The loans I think are now in half or less and in no way a burden (once again to stress for this career and not in a high priced medical specialty either).

It is actually cheap money and guaranteed loans that drive increases in tuition. Schools can only charge what people are ABLE to pay and government subsidies/guarantees have inflated what people can actually pay. If the government subsidies and guarantees are removed, schools will be forced to lower tuition. This is the only solution. The reason it is not implemented is too many people make a career/lots of money ripping students off.Mr. Schiff can explain better:https://www.youtube.com/wat…

This is true. In a way it’s similar to how the availability of money drove up housing prices. And many areas (for example where I am) have not recovered from the increase in price driven up by easy money and lax lending in the mid 2000’s.There is one other factor often overlooked and not entirely obvious with education. That is both foreign students and also students who attend public colleges and pay full tuition (not the in state rate) because they don’t live in the same state as the public college. So public colleges are incentivized to accept both of those types of students because they don’t pay the in state rate. My daughter as one example attended what is recognized as the best public college in NY State and paid full tuition. It is called ‘a public IVY’ (get that). This was good for her but maybe not good for the instate student who didn’t get in because she took their place. Similar to foreign students doing similar and paying full tuition (at both public and private schools). Now you can argue that those students are good to have because they add something to campus and to diversity etc. But the fact is that extra money does not apparently lower tuition for others as much as it just allows the college to spend more money similar to someone getting an increase in pay. They don’t live as if they don’t have the money they live as if they are in another income bracket.I attended an IVY league school ‘back in the day’. I calculated my inflation adjusted yearly tuition as $16,000 in today’s dollars (w/o housing) compared to about $55k in actual numbers today at the same school. Back when I went there my parents who were middle class had no problem paying the tuition at all and it was not a burden in any way. And in a true show of the governments lack of being able to manage programs I was able to take out student loans (which I didn’t need) and use that money to start my first business out of college. And I took years to pay way way past the point when I had the money to repay the loans.

Also, lack of a change in supply. It is impossible to start a new school. Even the College of Engineering at Illinois took a big hit when they did the right thing and started a new Medical Engineering school. Because the professors hadn’t “published” and they had no graduates, the US News rating took a hit.Supply line has an elasticity of 0. Only thing that happens when demand goes up is higher prices.

US News ratingThis (and similar rankings) are the source of a great deal of the ‘evil’ in education. Both that schools game things for those rankings [1] and that college bound students and parents pay attention to them. And likewise employers.I am against government regulation in general however I wonder why there is no consumer protection angle to this that can be explored. (Ditto for lists of best hospitals, doctors and so on).[1] A small example is trying to get as many applications as you can so you can reject and then appear to be more selective.

.Look into Public Service Loan Forgiveness Program.Almost anybody can get a complete free ride through Army ROTC scholarships, plus you get the GI Bill for grad school.”loanee” = borrowerJLMwww.themusingsofthebigredca…

If you look at VC, you have to go to Stanford, Cal, or Penn. Other schools are represented, but those are the top 3 by far. Same with private equity. If I want to be a SCOTUS, I have to go to Yale, Harvard, Columbia, Chicago or Stanford….When I speak at colleges, I like to tell students that the elite expensive private school kids fail just as fast an as often as the public school students. Don’t be intimidated.It is amazing how artificial constructs shape behavior. Try changing your source code at a bank. Try using a lawyer other than the big three or four for your PPM in VC.

Joanne, check out this company Lambda School I just invested in. The program totally works because they are investing in their students. It is a free tuition upfront until their graduates start making over $50k a year and then there is an income share agreement. I believe this is the future of higher education for many. https://lambdaschool.com/

Nice to see your name pop up in the commentsVery smart way to educating people in regards to debt. Somethings got to change