Women and Sports

We have watched the NCAA Sweet Sixteen for as long as I can remember. Over the years, women’s basketball has become more fun to watch. This year, the games were incredible. If you have not paid attention, Caitlin Clark, who played for Iowa, is not only one of the greatest female college athletes of all time but also the scoring leader for the entire NCAA.

Title IX mandated gender equality in sports 40 years ago. We are seeing the impact rise to the top. This year, the Liberty games had the highest attendance in the league’s history. The playoffs were packed. We took our kids to Liberty games when Becky Hammond played, and the stands were far from filled. Seeing these games now filled to capacity is amazing.

This list shows the top female players in the NCAA. Many of these women will go on to play professional sports with sold-out games. Caitlin Clark will be paid over $76k a year while her male counterpart will make $10.5m, roughly 140% less than her male peers. When will that change?

I understand that paying players has to do with attendance, sponsorships, etc., but as we begin to see crowded arenas for the female teams, I hope the owners make the salary changes quickly and show why.

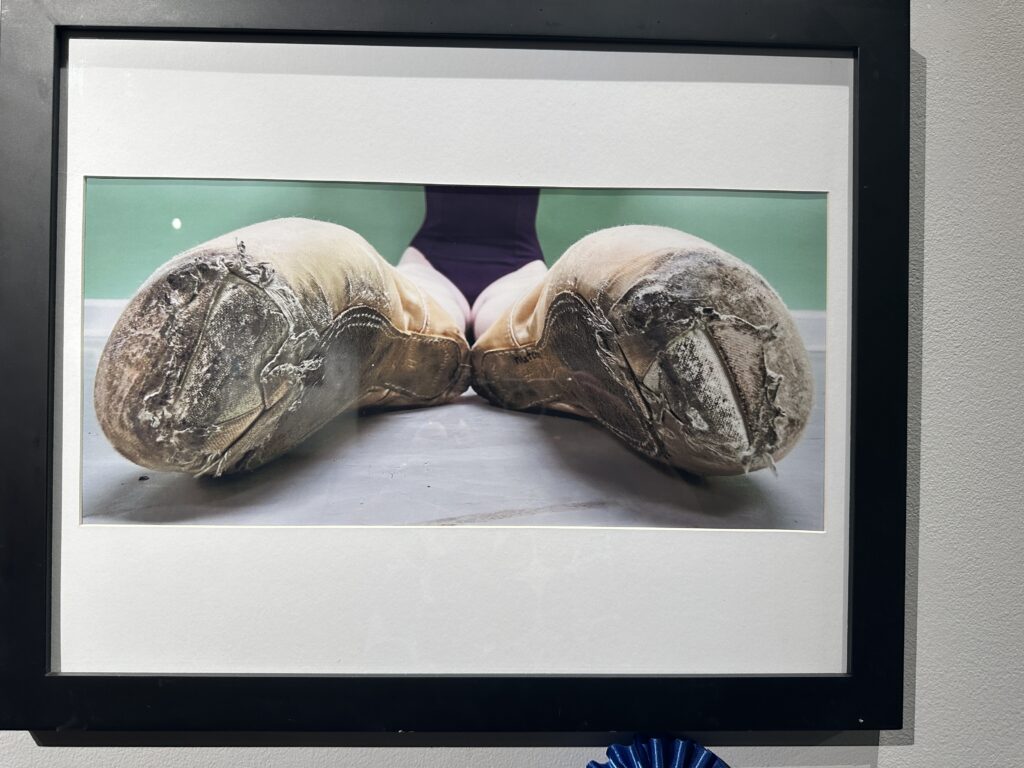

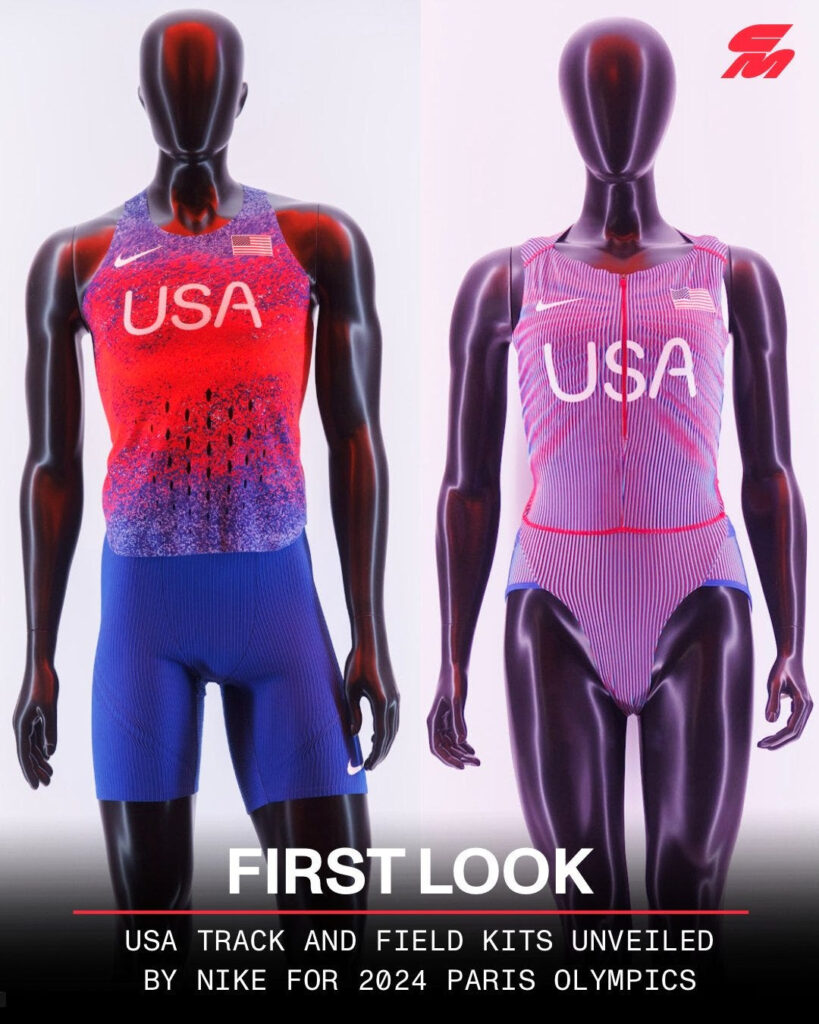

Seeing the Olympic tracksuits for women, where they are expecting all women to get a good bikini wax to wear them, points once again to promoting the sexuality of women and not their athletic ability. This statement says it all.

Lauren Fleshman, a retired U.S. world champion runner, had some harsher criticism to share. In an Instagram post, Fleshman wrote, “I’m sorry, but show me one WNBA or NWSL team who would enthusiastically support this kit. This is for Olympic Track and Field. Professional athletes should be able to compete without dedicating brain space to constant pube vigilance or the mental gymnastics of having every vulnerable piece of your body on display. Women’s kits should be in service to performance, mentally and physically. If this outfit was truly beneficial to physical performance, men would wear it.” She added, “This is not an elite athletic kit for track and field. This is a costume born of patriarchal forces that are no longer welcome or needed to get eyes on women’s sports. … Stop making it harder for half the population @nike @teamusa @usatf.”

All women in sports, particularly the ones succeeding at a high level, should be financially rewarded for their hard work and skills, and certainly it is time to stop sexualizing female athletes.